HyperQuant is a multifunctional platform for automated crypto trading, asset

management and dApps creation that is based on the Fast Order Delivery protocol

and blockchain technologies. It is made by professional quant traders who know

capital management industry inside-out

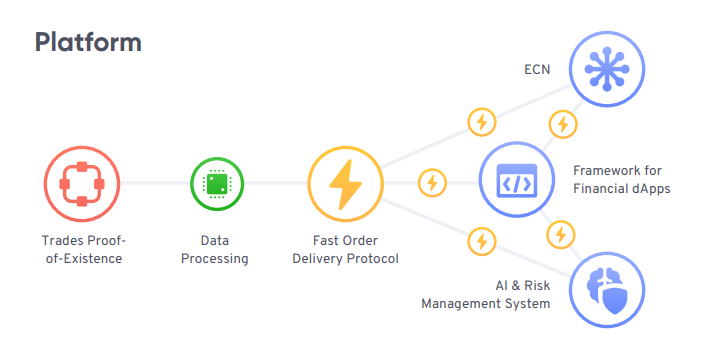

HyperQuant is a professional platform for automated crypto trading, asset management and dApps creation that is based on the cutting-edge AI, Risk Management, Blockchain technologies and Fast Order Delivery protocol. It is made by professional quant traders who know capital management industry inside-out. All market participants from minor crypto investors to professional capital managers, VCs and hedge-funds will have access to a broad variety of intelligent solutions covering all aspects of crypto investment and crypto trading processes.

Cutting-edge technology

Hyper FastFast Order Delivery protocol works hundreds of times faster than

similar solutions and provides the competitive advantage on

the market.

similar solutions and provides the competitive advantage on

the market.

Hyper SmartAll the components of the platform are managed by an AI & Risk

management system. It constantly evolves through machine

learning with the help of accumulated Market Data. The system

does not only enhance the algorithms on the platform but also

minimizes the associated risks.

management system. It constantly evolves through machine

learning with the help of accumulated Market Data. The system

does not only enhance the algorithms on the platform but also

minimizes the associated risks.

Hyper SecureBy using the power of immutable Ethereum blockchain and

cryptographic proofs of knowledge (Merkle proofs), we are

developing unique and transparent system. In this system, a

user can audit his/her operations and be sure that all the

trade deals have been actually made on the exchange. The

system itself is traffic and computationally efficient, so

even if it has 1,000,000,000 orders on a daily basis, proofs will

take only 1kb in size and require just 30 hashing operations.

cryptographic proofs of knowledge (Merkle proofs), we are

developing unique and transparent system. In this system, a

user can audit his/her operations and be sure that all the

trade deals have been actually made on the exchange. The

system itself is traffic and computationally efficient, so

even if it has 1,000,000,000 orders on a daily basis, proofs will

take only 1kb in size and require just 30 hashing operations.

A complex rating system is a right way for the development of the financial platform. A rating is the instrument’s potential in a certain period of time depending on the combination of quantitative and qualitative characteristics, expressed in a final digital mark. A rating can be calculated with the help of different statistical methods. In the world financial system the ratings are comprised by independent rating agencies — Moody’s, Standard and Poor’s as well as Fitch Ratings. They are used for evaluating the credit solvency of a company. Using such rating a potential investor can understand whether he/she should purchase the obligations of the firm and how reliable this investment is.

AI forms the investment rating based on its own analysis system. It can be shown to the user with any understandable graphic method. The investment success is analyzed using a wide range of criteria, exceeding the simple methods of risk-profitability evaluation.

In case of a rating mark going down — the neural network has an in-built alert system. If a user is performing risky actions, the trading result lowers or the portfolio element diversification is not high enough — the system displays a warning to the user. Similarly to a traffic light it varies depending on how critical the situation is. In the worst case scenario the system can block any access to the problematic element, thus avoiding the full investment loss.

In addition, a personal AI-based financial advisor will recommend how to configure bots and rebalance the crypto portfolios. Safety is also built in with an automated risk-management system and an easy-to-use visual bot constructor with built-in popular trading indicators making it ideal for investors to start making their own bots.

For developers and quant traders, HyperQuant can offer a professional quantitative framework that has many features including automating back-testing on historical market data, containing hundreds of trading indicators and ready-to-use algorithms. It also has tools to optimize trading strategies after they are launched and includes an open-source unified API protocol for all crypto exchanges.

AI forms the investment rating based on its own analysis system. It can be shown to the user with any understandable graphic method. The investment success is analyzed using a wide range of criteria, exceeding the simple methods of risk-profitability evaluation.

In case of a rating mark going down — the neural network has an in-built alert system. If a user is performing risky actions, the trading result lowers or the portfolio element diversification is not high enough — the system displays a warning to the user. Similarly to a traffic light it varies depending on how critical the situation is. In the worst case scenario the system can block any access to the problematic element, thus avoiding the full investment loss.

In addition, a personal AI-based financial advisor will recommend how to configure bots and rebalance the crypto portfolios. Safety is also built in with an automated risk-management system and an easy-to-use visual bot constructor with built-in popular trading indicators making it ideal for investors to start making their own bots.

For developers and quant traders, HyperQuant can offer a professional quantitative framework that has many features including automating back-testing on historical market data, containing hundreds of trading indicators and ready-to-use algorithms. It also has tools to optimize trading strategies after they are launched and includes an open-source unified API protocol for all crypto exchanges.

- Private sale : May - June, 2018

- Public pre-sale : July, 2018

- Ticker : HQT

- Token type : ERC20

- TGE Token Price : 1 HQT = 0.00028 ETH

- 1 ETH = 3500 HQT

- Fundraising Goal : 41, 143 ETH

- Total token supply : 320 000 000 HQT

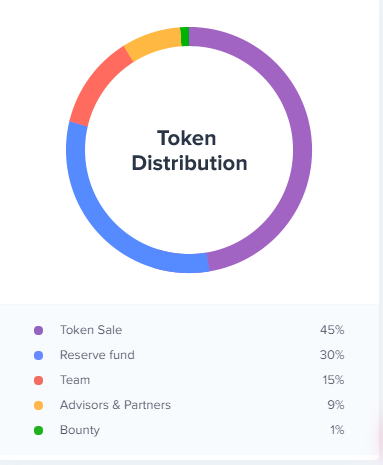

- Available for token sale : 45%

- Country : Estonia

- Accepting : ETH

- Whitelist : Yes

- KYC : Yes

Lock-up period : Team - 1 year after the Token Generation Event

Advisors - 6 months after the TGE

Bonus - 3 months after the TGE (each months 1/3 is unlocked)

Bonuses for institutional investors will be locked up to 6 months.

Unsold tokens : Frozen for 2 years

Advisors - 6 months after the TGE

Bonus - 3 months after the TGE (each months 1/3 is unlocked)

Bonuses for institutional investors will be locked up to 6 months.

Unsold tokens : Frozen for 2 years

Distribution token

2015 - Original Idea

Coming up with idea

Market research

Concept evaluation with industry experts.

First Experiments

Coming up with idea

Market research

Concept evaluation with industry experts.

First Experiments

2016 - Platform Blueprint & Pre-Alpha

Preparing Whitepaper

Legal Paperwork

Developing Trading strategies and backtesting them on real market data.

Building connectors to crypto trading platform.

Preparing Whitepaper

Legal Paperwork

Developing Trading strategies and backtesting them on real market data.

Building connectors to crypto trading platform.

2017 - Alpha

1.Blockchain based investment plans

Mobile application for bot Management

Hyper Token Distribution

Smart order routing and fast order execution protocol

Trading bot market-place

1.Blockchain based investment plans

Mobile application for bot Management

Hyper Token Distribution

Smart order routing and fast order execution protocol

Trading bot market-place

2018 - Open beta

Market Data Storage

Quantitative Framework with Powerful SDK

Market Data vendor Unified protocol

Visual trading bot constructor (HQ script)

Market Data Storage

Quantitative Framework with Powerful SDK

Market Data vendor Unified protocol

Visual trading bot constructor (HQ script)

2019 - B2C Solutions & AI

Effective execution of big trading orders

Risk Management & Hedging Software

AI Financial Advisor based on big data & neuro network

Investment management software for crypto hedge funds

Effective execution of big trading orders

Risk Management & Hedging Software

AI Financial Advisor based on big data & neuro network

Investment management software for crypto hedge funds

Formore information :

Website : https://hyperquant.net

Whitepaper : https://hyperquant.net/en/wp/

Medium : https://medium.com/hyperquant

Facebook : https://www.facebook.com/hyperquant.net/

YouTube: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

Twitter: https://twitter.com/HyperQuant_net

Telegram: https://t.me/hyperquant

My addres: 0x314eeD7e7eDDDD5f3364F057EAA7114483337bA0

No comments:

Post a Comment