WHAT IS JUNCA CASH

Junca Cash has a big difference from other crypto assets like Bitcoin. This is an important way to adapt the Philippine economy as it has a lot of useful logistics, based on local needs.

Junca Cash is the base or primary currency of the Junca platform. The Junca platform complements the Philippine economic system as it offers a variety of use cases based on the needs of the local community.

The Junca platform, unlike other cryptocurrency investment platforms, has been developed for those who need a permanent solution to the problem of cross-border remittances for OFW and the Philippines.

The Junca platform offers fintech as well as cryptocurrency services to support international and domestic remittances, ATM payments, exchanges and more at significantly lower fees when compared to other systems. This platform aims to enrich the lives of Asian people, especially the Philippines. If you are inclined towards cryptocurrency investing and want to invest in new crypto assets, then you can easily choose Junca Cash offered by the Junca platform.

OFW ECONOMIC CONTRIBUTION REMITTANCE

OFW has been considered a major contributor to the growth and progress of the Philippine economy. Remittances provided by OFW accounted for around 11% of the country's GDP in 2018. Remittance inflows have been increasing in the Philippines. In 2014, its value reached $28 billion and then rose to $34 billion in 2018. As such, the Philippines is one of the top five countries in the world to benefit the most from remittances.

BoP or Balance of Payments: This is an important indicator of a country's economic health. A surplus indicates that the country has earned far more than it might have spent during a given period. On the other hand, a deficit implies that the country has spent more dollars than it might have earned. Remittances sent through a financial system that operates legally are immediately caught in the country's BoP which is monitored by the Philippines' central bank, namely Bangko Sentral ng Pilipinas. Remittances show how significant the income of Filipinos working overseas is. These remittances are transferred to the OFW family as well as the Philippines BoP.

Exchange rates show how healthy a country's currency is compared to other countries' currencies. The peso (the Philippine currency) strengthened as OFW remittances increased. This implies that it is much more in relation to other foreign currencies. So, when remittances flow smoothly, it empowers countries to buy more international goods & services. It also shows that the country is now in a good position to pay off all of its foreign debt apart from its other global obligations.

Foreign exchange reserves, also known as GIRs (Gross International Reserves), incorporate all foreign exchange, including foreign exchange, foreign investment, gold and special drawing rights. Gross International Reserve is one of the key components of any economy as it is used to manage the exchange rate of a country's currency against increased volatility. As far as OFW remittances are concerned, it is one of the best ways to grow Foreign Exchange Reserves. In fact, in June 2019, the Philippines' GIR increased to $85.38 billion.

Household income: Many households in the Philippines depend on remittances. Other households receiving domestic income use remittances to supplement their income. As such, remittances abroad are an important part of the regular income of some Filipino families.

Standard of Living: When remittances are given to family members, they use it to improve their overall standard of living. Many economists believe that remittances abroad directly result in increased education, health care, and entrepreneurial activity of Filipinos.

Purchasing power shows the amount of goods/services one unit of currency can buy. As far as cross-border remittances are concerned, they are considered one of the main drivers of domestic demand. OFW remittances help finance private consumption in the Philippines as it increases the purchasing power of individuals.

JCC OR JUNCA CASH ADVANTAGES

- Domestic remittance

- residence

- Unique benefits at Junca Group stores as well as franchise stores once you become a member.

- International money transfer for OFW

- Donations for scholarships and funds, etc.

- International currency exchange

- Cryptocurrency and fiat currency exchange

- Redemption at ATMs (domestic and international remittances, Deposits, Withdrawals)

HOW IT WORKS – JUNCA PLATFORM?

Cryptocurrency investing is something that interests you, so Junca Cash is undoubtedly a good choice. Users can purchase Junca Cash from cryptocurrency investment and trading exchanges, or they can approach Junca member groups directly to purchase JCC.

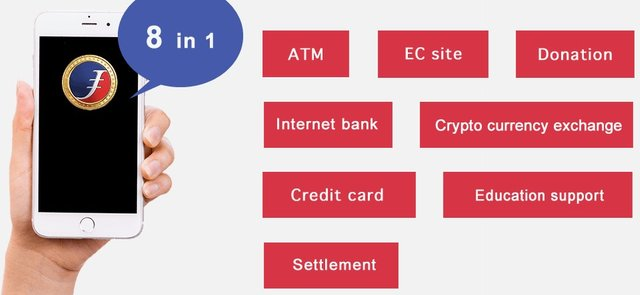

Once you have Junca Cash in your wallet, you can use it to exchange at ATMs. Using the Junca App, users will be able to manage and control their deposits & withdrawals without inserting their card. In addition, Junca Cash can also be used to shop at several shopping sites offered and partnered with the Junca group. The Junca platform also allows JCC users to make donations to programs that support people around the world. These programs, powered by the Junca platform, will help uplift people in different countries, especially in Asia.

Apart from the above, the Junca platform also allows its users to use Junca Cash for money transfers and balance inquiries. As a result, users can use Junca cash to initiate banking services and make deposits & withdrawals. Apart from the above, Junca will also offer cryptocurrency exchange services, education support, credit card and settlement services to its users.

JCC WALLET AND HOW IT WORKS

The Junca platform aims to improve the Asian economy by simplifying and speeding up the process of cross-border remittances. People who choose to invest in Junca Cash must also use the JCC wallet, which is currently available on the Google Play Store, to store and use their JCC tokens. JCC Wallet can be used securely to send and receive Junca Cash on your smartphone. The wallet app also lets users manage their total assets as well as usage history. Junca also plans to update the JCC wallet in the future to include new options.

List of exchanges available for purchase

p2pb2b: https://p2pb2b.io/trade/JCC_USDT/

coinsbit: https://coinsbit.io/id/trade/JCC_USDT

Azbit: https://azbit.com/exchange/JCC_USDT

#JCC #juncacash #airdrop #giveaway #aladd1ncenter #Bounty #Azbit

coinsbit: https://coinsbit.io/id/trade/JCC_USDT

Azbit: https://azbit.com/exchange/JCC_USDT

CONCLUSION

By facilitating cross-border remittances and revolutionizing the human resource development system with the help of blockchain technology, Junca plans to transform the Philippine economy and change it for the better.

#JCC #juncacash #airdrop #giveaway #aladd1ncenter #Bounty #Azbit

For more information:

Situs web: https://junca-cash.world/

Whitepaper : https://junca-cash.world/junca_platform_WP.pdf

Facebook : https://www.facebook.com/juncacash

Twitter : https:// twitter.com/JCC78549683

Telegram : https://t.me/juncafangroup

Whitepaper : https://junca-cash.world/junca_platform_WP.pdf

Facebook : https://www.facebook.com/juncacash

Twitter : https:// twitter.com/JCC78549683

Telegram : https://t.me/juncafangroup

No comments:

Post a Comment